Top 5 Real Estate Investing Strategies for Beginners

It’s no secret that the real estate market has been on fire for the past several years. With record low inventory, historically low mortgage rates, and sky-high demand, properties are literally flying off the shelves. Many savvy investors have looked at these market conditions as a way to potentially cash in by purchasing properties with the idea of reselling them quickly for a significant profit.

Real estate investing itself is not a new concept, but the amount of people entering the market these days is far more than ever before. So, how do you get in on the action? Throughout this article, we will take you through some of the most common real estate investing strategies, show you what the risks are, and talk about the potential success you may find if you decide to invest in real estate.

Before you get started….

Real estate investing is not something you just decide to do on a whim. It is extremely important that you understand the risks involved and develop a personal plan of attack that includes short-term and long-term financial goals. The last thing you want to do is get in over your head and involved in something that is financially straining or something that you aren’t comfortable with. Talk to your financial advisor before making any decisions.

Table of Contents

Real Estate Investing Strategies

The real estate market offers many potentials for income generation and asset accumulation. Unfortunately, investing in property may prove challenging for those just starting out.

Fortunately, there are various strategies for investing in real estate. To find the one that offers you your desired returns while limiting risk, it’s important to understand your investment style and identify which option best meets your objectives.

The following is a list of the basic real estate investing strategies for beginners.

1) Wholesaling

Wholesaling can be a great way for beginners to get into real estate investing. What is wholesaling? Wholesaling real estate is a strategy where you (the investor) enter into a contract on a home with the intent to then turnaround and sell that contract to a new buyer/investor. Think of yourself as a middleman. Let’s look at an example…

- The owner of a distressed property is looking to sell but doesn’t have the means or time to sell it in a traditional manner. A wholesaler enters into a purchase contract with the seller for $200,000 with a 30-day close. The goal of the wholesaler is to sell the home to an interested buyer before the contract with the original homeowner closes. Let’s say that within a week, the wholesaler finds a new buyer that is willing to pay $225,000 for the home. From this, $200,000 would be used to satisfy the original contract with the homeowner and the wholesaler would keep the $25,000 difference as profit. The wholesaler never actually owns the home or puts any money down out of pocket.

In this example, the seller avoids having to pay for costly repairs or wait months on end to find a buyer the traditional route and is guaranteed a $200,000 payment for their home. The benefit to the wholesaler of course is that they are agreeing to pay the seller well below market value, allowing them to find a new buyer quickly and thus pocketing a potentially significant profit.

Wholesaling real estate is a great option for beginners because it requires very little upfront investment, leads to potentially large profits, and can be done relatively quickly.

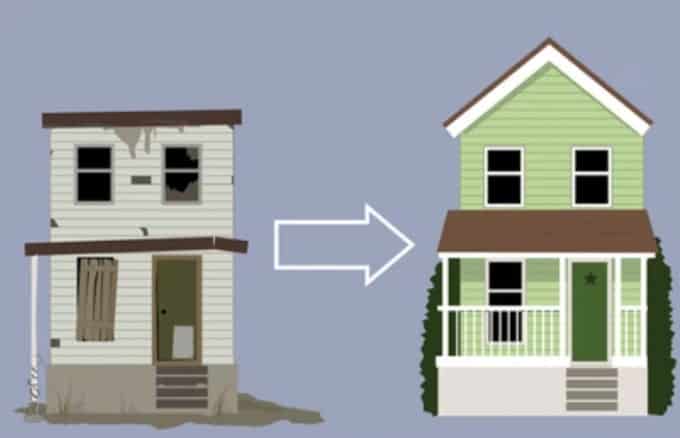

2) House Flipping

Everyone who watches even a little bit of HGTV knows the general concept of house flipping. It seems simple enough. Buy a house that needs some work done for less than market value, perform the necessary improvements, and sell for more than what has been invested.

While it may seem simple, there are a lot of pitfalls and risks that come with flipping a house. As an investor, the cost of paying for and maintaining a property until it is flipped falls squarely on your shoulders. Financing costs, utilities, insurance, HOA fees, taxes, closing costs, and repair costs are all on you. That’s not to say that house flipping can’t be profitable, because if done right, it absolutely can be. It’s just to make you aware that it’s more than simply just buying, fixing, and selling.

Related: Realeflow Review: Everything you Need to Start Investing … Almost

There is a lot of strategy and planning that goes into house flipping, so make sure you do your research and map out as many scenarios as you can think of before diving in and purchasing a property.

3) Buy and Hold

This may be the most common form of real estate investing. The buy and hold strategy is simply the strategy of purchasing a property with the intent to own it for a long period of time while finding a tenant to provide rental income. This is a lower risk strategy then wholesaling or house flipping, but it also is far less profitable and can take years to recoup even your initial investment.

Buying and holding real estate is a great way to generate passive income while also holding onto an asset that will presumably increase in value over time.

Keep in mind that because you are holding onto the property for the long run, you are responsible for property management, maintenance, unoccupancy, and repairs. One bad tenant can be detrimental to your bottom line, so be thorough and selective in your search.

4) Lease to Own

Lease to own is essentially an offshoot of the buy and hold strategy. Instead of owning the property in perpetuity, you find a tenant who enters into a lease to own agreement that grants them the right to purchase the property at a future date. This can be beneficial in the short term because it provides the investor with reliable passive income, and it can also be beneficial in the long-term knowing that down the road, there will be someone willing to purchase the house.

5) Short Sales

A short sale is a real estate transaction where the property owner’s lender agrees to sell to a new buyer for less than what is owed by the original owner. This typically occurs when the original owner is underwater on their mortgage and the bank (or lender) is trying to offload the property before going into foreclosure.

Buying a short sale home can be a great way of purchasing a property dirt cheap. After purchasing, you have options of what to do next. You can make repairs and flip the home for market value. Or you could make it rentable and find reliable tenants to provide you with immediate passive income.

The hardest part about short sales is finding them. It’s a highly competitive market and knowing the right people and having relationships with lenders is extremely important.

Conclusion

Real estate investing can be a great way to achieve financial independence. But it’s important to keep in mind that no investment strategy is perfect, and there are always risks involved. As a result, it’s important to consider your overall risk tolerance before investing in any type of real estate.

Choosing the best real estate investing strategies for you depends on several factors, including your goals, circumstances, and risk profile. Each real estate investor has a unique set of property strategies that they use to build wealth and financial freedom, but these strategies all share some common features.

Real Estate Investing Strategies for Beginners FAQ’s

Should I Invest in Real Estate?

Are You Thinking About Investing In Real Estate? Before making a decision to do so, there are some essential considerations you should know.

Are You Wondering If Real Estate Investing Is Worth Your Considerations

Real estate investments have long been proven an excellent way to build wealth. Less volatile than stocks, real estate allows your portfolio to continue expanding even during difficult economic times.

Is Starting in Real Estate Investment Easy?

Before investing in real estate, it is important to determine how much of your own money you wish to put down as the costs involved with purchasing or renting can be significant – not to mention any costs related to maintenance and other expenses in the future.

Should I Invest in Rental Property?

Owning rental property can be an excellent way to generate monthly income; just be sure that its value increases over time so you can sell it at a profit later on.

Are we entering an ideal market to invest in real estate now?

Real estate investments have proven difficult for many in recent years due to rising mortgage rates, inflation and other factors causing real estate prices to remain stagnant or decrease over time. But now may be an optimal time to get in.

Are home values always increasing in value? Its Owning real estate that will appreciate over time is an excellent investment strategy, providing monthly rental checks while waiting for its appreciation.

Is Becoming a Landlord Difficult?

Becoming a landlord can be an excellent investment strategy to generate passive income and build wealth; however, it is recommended that before making this decision you carefully assess all risks involved with becoming a home landlord.

Before making any commitment, be sure to conduct extensive research of both your local market and personal financial situation. Conduct a cost-benefit analysis in order to establish which risks can be taken and how much insurance coverage will cost.

Step One of Becoming a Home Landlord

The initial step to becoming a landlord is purchasing and renting out your property. You may be able to pay cash, or may need a mortgage.

Once you own your property, the next step should be preparing it for tenants – an often challenging and time-consuming endeavor that may take months or more to accomplish.

Be ready for unexpected maintenance and repairs that need your attention, such as when an AC fails during a heatwave or your tub overflows due to leaks; such issues must be taken care of immediately.

Locating and Screening Tenants

One of the primary challenges for new home landlords is finding tenants willing to pay a reasonable rent. You may need to spend money on advertising or even work with a realtor in order to find them.

Maintaining Your Property

Aim to set aside at least 1% of the value of the property for annual maintenance as well as long-term repairs such as roof or siding replacement, plus business insurance to safeguard yourself against potential claims and any possible eviction proceedings.

What Are Some Tips on How to Invest in Real Estate?

Real estate investing can be an excellent way to generate income and build wealth. Real estate investments also provide tax benefits and principal security; however, before making your decision it is crucial that you consider all risks.

There are various strategies you can employ when investing in real estate, including renting properties, fixing and flipping them, wholesaling properties and investing in commercial property.

Start small if you’re new to investing in real estate – even just with several hundred dollars at first! As with anything worthwhile, investment must start small and gradually grow over time.

Choose a strategy that aligns with your goals and risk tolerance. Make sure it is something you can commit to, as sticking with it will help you reach your objectives more quickly.

Do your research and become as informed as possible about real estate investment. There are plenty of books, websites and podcasts that will teach you everything there is to know about real estate investment.

Maintain Current Real Estate Data: Inaccurate data can hinder your investing success. Knowing how the market has developed over time allows you to make better investment decisions with complete knowledge.

Be Patient: Finding and investing in properties takes time; otherwise, mistakes could cost you dearly in the form of missteps and subsequent losses. Becoming impatient could prove disastrous!

What Are Some Real Estate Investment Examples?

Real estate investing is the practice of purchasing property to generate income. While real estate investment may offer an exciting diversification opportunity for your portfolio, it also comes with several risks. No matter whether it’s your first time out or an experienced pro in this space, it’s vitally important that you understand all your options when starting out or expanding on current holdings.

Active Investments

Traditional real estate investment opportunities involve purchasing properties and renting them out to tenants. Although this form of investing requires minimal hands-on involvement, it still takes considerable time and physical labor.

Passive Investments

A passive approach to investing involves purchasing shares in real estate investment trusts (REITs) or crowdfunding platforms – providing those without access to huge funds a means of entering real estate investments.

Core Investments

A core real estate investment refers to any purchase of property which will generate stable long-term income, often on multi-decade leases. Such properties tend to be in good condition with minimal renovation needed before they can be rented out as rentals.

Value-Add Real Estate

Value-Add real estate refers to commercial properties with existing income but presenting significant opportunities for improvement such as market repositioning or operational upgrades, which offer the chance for both revenue generation and increasing property values simultaneously. This strategy offers an efficient means of increasing both.

Land Speculation

One of the more popular ways of investing in real estate is land speculation, or “speculation”. Land speculation allows investors to capitalize on land that has yet to be developed, while making a profit through it – but requires significant knowledge and research beforehand.

What is Real Estate Crowdfunding?

Real estate crowdfunding enables investors to diversify their investment portfolio without directly purchasing properties. Instead, investors pool their money with other investors and invest in fractional shares of a residential or commercial property; some platforms even allow nonaccredited investors to participate.

What Are the Pros and Cons of Real Estate Crowdfunding?

Real estate crowdfunding can be an effective way for individuals to enter the real estate industry. Thanks to online crowdfunding platforms, investing in real estate projects has never been simpler – though it is essential to select an informed platform before investing your money.

Before investing through a crowdfunding platform, it is crucial to fully comprehend how it works and the advantages you will receive from such investments. An ideal platform will offer flexible options designed to suit individual requirements while offering you investment opportunities best suited for your circumstances.

One major disadvantage of real estate crowdfunding is not having control of the property you invest in; for instance, if a rent payer doesn’t pay their rent or is lacking funds to maintain and repair their dwelling then your investment could become threatened and you risk the chance of loss.

There are ways to mitigate risk while still reaping the rewards from investing in real estate via crowdfunding platforms. One approach is REITs or managed portfolios, which provide an equity stake and offer dividends on your investments. You could also consider private market investments which offer higher returns than publicly traded REITs.

What Are Real Estate REITs?

REITs offer a great way to diversify and generate income, according to Matt McCarthy of NerdWallet. REITs often boast high dividend yields as an indicator of their financial health.

REITs offer an effective hedge against the rapid ups and downs of stocks, so they may help you protect your capital when markets dive. But REITs don’t suit every investor – before making this decision it is essential that you consider your individual risk tolerance and investment goals before determining whether this asset class is right for you.

REITs must meet certain qualifications and adhere to specific operating requirements set by the Securities and Exchange Commission in order to qualify as REITs. They must derive at least 75% of their gross income from real estate investments and distribute at least 90% of taxable income as dividends annually to shareholders.

REITs must also have a board of directors or trustees and fully transferable shares for management and operation, with at least 100 shareholders held by individuals during their first year and no more than 50% held by five or fewer during their last half of taxable year.

How to Invest in Real Estate With No Money Down

Have you ever dreamed of owning real estate? Do you worry that funding to get started could be an obstacle? Many aspiring real estate investors do.

There are various strategies available for investing in real estate without making a large initial capital outlay. Professional real estate investors use creative financing solutions:

Real Estate Wholesaling

Real estate wholesaling is an extremely popular way to invest in real estate without having a lot of money upfront. Wholesalers are often referred to as “flippers,” and the process is very similar to house flipping.

With the right skills and resources, becoming a real estate wholesaler could be an enticing career option. The most popular form of wholesaling is finding properties at a discounted price, then putting them under contract. Afterward, you can sell the contracts to investors for a higher price.

To become a successful wholesaling real estate investor, you need to be able to find the right properties that fit your specific investment criteria. For example, you may want to target distressed properties that need renovation and are likely to attract buyers.

Distress properties include foreclosures, inherited houses and other types of homes that have liens can be very lucrative. If the property is in need of repair or has a low price point, it can be easy to get the property under contract at a deep discount and then assign your purchase contract to a buyer who can fix up the house and either sell it for a profit or rent it out.

The easiest way to get started in wholesaling is to start a cash buyers list. This means collecting names, email addresses and phone numbers from investors that you think might be interested in purchasing homes at a discount before passing them on to your own list of prospective clients.

You might also like: